Understanding the Decision

For businesses, the choice between leasing and buying equipment is often pivotal. Beyond operational considerations, understanding the tax implications of each option is crucial for making informed financial decisions. In this blog post, we delve into the tax implications of leasing versus buying equipment, offering insights to help businesses navigate this critical choice effectively.

Tax Implications of Leasing Equipment

Introduction to Leasing Equipment

Explain the concept of leasing equipment and its benefits in terms of cash flow and flexibility.

Details and Implications

Discuss tax deductions available for lease payments, including operational expense deductions.

Tax Implications of Buying Equipment

Introduction to Buying Equipment

Discuss the advantages of buying equipment outright, such as asset ownership and long-term cost benefits.

Details and Implications

Explain depreciation deductions, Section 179 deductions, and bonus depreciation benefits available for purchased equipment.

Comparative Table

| Aspect | Leasing | Buying |

|---|---|---|

| Tax Deductions | Operational expense deductions | Depreciation, Section 179, and bonus depreciation |

| Cash Flow | Better cash flow flexibility | Potential higher initial cost |

| Ownership | No ownership of asset | Full ownership and long-term benefits |

Comparative Analysis: Case Studies

Introduction to Case Studies

Present hypothetical or real-world examples comparing tax outcomes for leasing versus buying equipment.

Details and Implications

Provide case-specific details, financial outcomes, and lessons learned from businesses in similar industries.

Strategic Considerations

Introduction to Strategic Considerations

Discuss factors businesses should consider when weighing leasing versus buying decisions, beyond tax implications.

Details and Implications

Include factors such as business cash flow, equipment utilization, maintenance costs, and future growth projections.

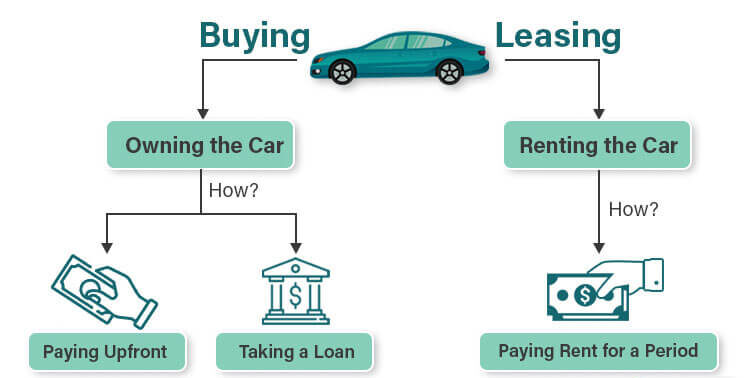

Decision Matrix

Create a decision matrix or flowchart illustrating key considerations for choosing between leasing and buying equipment.

Summary of Key Points

Summarize the blog’s main points, emphasizing the importance of understanding tax implications in equipment acquisition decisions.

Encourage readers to evaluate their specific business needs, financial goals, and tax situations when deciding whether to lease or buy equipment.