Navigating the tax implications of employee benefits is crucial for businesses aiming to attract and retain talent while managing costs effectively. Employee benefits encompass a wide range of offerings—from health insurance and retirement plans to fringe benefits and stock options—each carrying its own tax considerations. We’ll delve into the key tax implications associated with various employee benefits, offering insights, strategies, and best practices to help businesses navigate this complex landscape.

Understanding Employee Benefits and Their Tax Implications

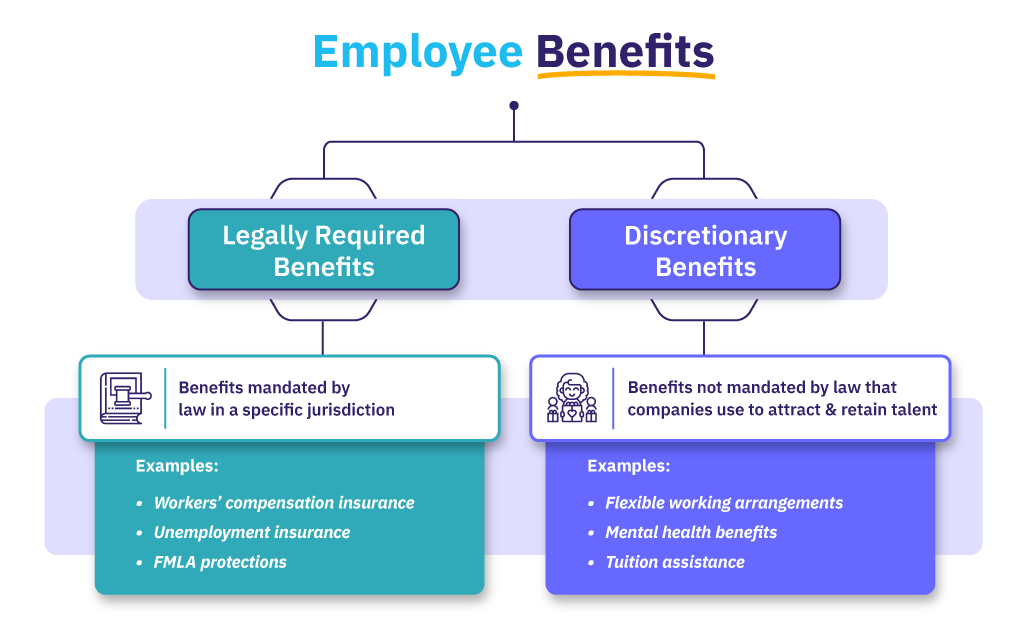

Employee benefits play a significant role in the overall compensation package offered by employers. The tax implications vary depending on the type of benefit provided and how it’s structured. Here are some common employee benefits and their tax considerations:

1. Health Insurance:

- Employer-paid premiums for health insurance are generally tax-deductible for the employer.

- Employee contributions to health insurance premiums may be made on a pre-tax basis through a cafeteria plan (Section 125), reducing taxable income.

- Employer-provided health benefits are excluded from an employee’s taxable income.

2. Retirement Plans:

- Contributions to qualified retirement plans (e.g., 401(k), IRA) are typically tax-deductible for employers.

- Employee contributions to traditional 401(k) plans are made on a pre-tax basis, reducing taxable income.

- Withdrawals from retirement plans are generally taxed at ordinary income tax rates, subject to certain exceptions.

3. Fringe Benefits:

- Fringe benefits such as company cars, meals, and educational assistance are subject to specific tax rules and limitations.

- Some fringe benefits may be taxable to employees, while others may be excluded from taxable income up to certain limits.

4. Stock Options and Equity Compensation:

- Incentive Stock Options (ISOs) and Non-Qualified Stock Options (NQSOs) have different tax implications upon exercise and sale.

- Equity compensation, such as restricted stock units (RSUs), may be subject to taxation at vesting or upon sale.

Tax Strategies for Optimizing Employee Benefits

Effective tax planning can help businesses optimize their employee benefits programs while managing tax liabilities. Consider these strategies:

- Maximizing Tax-Advantaged Benefits: Offer benefits that provide tax advantages for both employers and employees, such as health savings accounts (HSAs) and flexible spending accounts (FSAs).

- Structuring Retirement Plans: Choose retirement plan structures that maximize tax benefits, such as matching contributions or Roth options.

- Educating Employees: Provide comprehensive education on the tax implications of benefits to help employees make informed decisions and maximize tax savings.

Case Study: Company XYZ’s Benefits Strategy

Company XYZ, a tech startup, wanted to enhance its benefits package to attract top talent. By structuring a combination of health insurance plans with flexible spending accounts (FSAs), they offered employees the flexibility to manage healthcare costs efficiently while optimizing tax savings. This strategy not only improved employee satisfaction but also reduced payroll taxes for the company.

Compliance and Regulatory Considerations

Navigating tax implications of employee benefits requires compliance with regulatory requirements and adherence to IRS guidelines:

- Reporting Requirements: Ensure accurate reporting of employee benefits on W-2 forms and other tax documents.

- ERISA Compliance: Follow Employee Retirement Income Security Act (ERISA) guidelines for retirement and health benefit plans.

- ACA Compliance: Adhere to Affordable Care Act (ACA) regulations for offering health insurance coverage to employees.